The Money Book Circle series – Q4 2024 edition

A quarterly series on the hottest new books on finance and technology

On the go? No problem. We have you covered with the audio version:

Book #1: “Digital Currency or Digital Control? Decoding CBDC and the Future of Money”

by Nicholas Anthony

Nicholas Anthony delivers the perhaps best book on central bank digital money so far. Fintech experts agree on two things: First, blockchain technology has the potential to upend the way we are moving money. Second, it will not be cryptocurrencies that will do so. Thus, over the last few years, the idea of CBDCs – central banks issuing digital fiat currencies – took center stage and increasingly came to look like an inevitability. Congress ended that narrative in a landmark bill this May, specifically banning the Fed from issuing a CBDC. This decision is the best proof that Nick Anthony’s Digital Currency or Digital Control is right on spot. Many books and articles have been critical of CBDCs, but this one is the most substantiated and most comprehensive analysis.

Anthony sheds light on six major problems with CBDCs, each of which on its own could be reason enough for central banks (in the free world at least) to back down from their CBDC plans. First and foremost, despite the best efforts of central bankers and politicians there has been no clearly articulated benefit of a CBDC. Everything they promise can be done more efficiently by the private sector. Second, CBDCs will end financial privacy by aggregating the users’ financial lives in one place and by restricting their choices. Third, a CBDC lets its controlling entity restrict users’ freedoms by defining where and how they can spend money. Behaviors could be controlled, for example stimulating spending by implementing negative interest rates. Fourth, a wide-spread adoption of CBDCs would destabilize cryptocurrencies and commercial banks. Many experts have already warned of liquidity shocks if deposits move from the balance sheets of commercial banks to those of central banks. Fifth, CBDCs would weaken cybersecurity by centralizing citizens’ deposits and thus incentivizing would-be hackers. Finally, CBDCs could even undermine and politicize the Fed and other central banks.

Even if, especially if, you are a proponent of CBDCs you should read this book. CBDCs might make it in America or Europe after all, but even then it matters hugely how they are implemented and whether their usage is mandated. Hence, knowing about the dangers and problems of CBDCs is incumbent for every public and corporate decision maker, and I would argue every voter. This is where Digital Currency or Digital Control comes in again, because a great feature of the book is its brevity. In about a hundred pages it gets you up to speed, even if you have never before delved into the subject of CBDCs. A lack of time is no excuse for not reading it.

Nicholas Anthony is a policy analyst at the Cato Institute’s Center for Monetary and Financial Alternatives and a leading pundit on the digital dollar. He has testified before Congress and maintains the HRF CBDC Tracker, which documents CBDC development and civil liberties concerns around the world. I recently interviewed Nicholas for The New Frontier. We talked about the costs and risks of central bank digital currency, whether the bill banning the Fed from issuing a digital dollar means the end for CBDCs in America and what it could mean for a digital euro and a digital pound, and whether CBDCs and private stablecoins could co-exist. Read the full story here.

Book #2: “You Weren't Supposed To See That: Secrets Every Investor Should Know”

by Joshua M. Brown

Can a collection of blog posts make for a good book? In You Weren’t Supposed to See That Josh Brown proves that it can. One of the original Wall Street bloggers, star of CNBC’s Halftime Report, and CEO of Ritholtz Wealth Management, Brown collects and shares crucial secrets every investor should know, all of which are as relevant today as on the day he postulated them for the first time. Drawing on 15 years of publishing The Reformed Broker, a highly popular financial blog, he revisits, updates, and expands on the best of his wildly popular writing. In doing so, he pulls back the curtain on Wall Street, promising to equip readers with the "secret weapons" of successful investors.

Brown delves into the often-opaque world of finance, revealing what traditional financial advice fails to address. He tackles critical themes like the impact of automation, social media, and passive investment strategies on the financial landscape. Most of these topics will be familiar to reflected investors: Don’t let social media and your emotions sway your strategy. Simplicity trumps complexity in the investment world. And passive investing has soared over the past years. There is, however, a very fresh angle on tech investing.

Readers of The New Frontier will probably find the lessons on automation and the current technological upheaval most interesting. In Brown’s view, tech giants like Meta or Google are poised to run even more of our economy than they do today. At the same time, they will displace ever more people from their jobs. In a mentality that can best be summarized as “if you can’t bet them, join them” many investors flock to Big Tech. They are a life-insurance for future financial survival. It is the only safe-haven left, as even highly-educated white-collar workers are threatened by AI and other technologies. This trend might fuel the first ever investment bubble driven by fear. The paradox situation is, the more capital is funneled into these groundbreaking technologies and the corporations seemingly dominating them, the sooner those seismic shifts will take place.

Brown's refreshingly direct and honest writing style shines through. He leverages his background as a Wall Street insider to provide a relatable and engaging experience for readers, especially those unfamiliar with financial terminology. While the book draws on Brown's experience managing billions of dollars, the core principles are relevant to a wide audience. Above all, its adds a valuable perspective on whether to invest in Big Tech.

Book#3 “The Little Book of Bitcoin: What You Need to Know That Wall Street Has Already Figured Out”

by Anthony Scaramucci

Are you thinking of Bitcoin as an investment opportunity rather than an antidote to traditional banking? Then The Little Book of Bitcoin is for you. Anthony Scaramucci, Bitcoin-bull and founder of SkyBridge Capital has written a handy, yet comprehensive guide to digital assets and the technology beneath it. It covers Bitcoin’s history, the technological fundamentals, but it also looks beyond that and sketches out tomorrow’s world of decentralized finance. Moreover, The Little Book of Bitcoin also answers questions many crypto-investors are still racking their brains over. What are stablecoins used for? Is it true that there is no privacy on the blockchain? And what does Wall Street think about all of this?

What I liked most about Scaramucci’s book was his perspective on Bitcoin as an investment manager. Admittedly, he does talk a good deal about very basic things like hashes or mining, the kind of concepts known even to the very remotely interested audience, but unlike many other books The Little Book of Bitcoin doesn’t lose itself in the technical and foundational details. Rather Scaramucci illustrates impressively how this completely new type of asset was able to capture wide-spread admiration even on Wall Street and in doing so became today’s hottest asset. I particularly liked the chapter in which Scaramucci describes how traditional finance became enthralled with cryptocurrency despite having strong reservations at first. Another chapter that deserves to be highlighted is the one about the rise (and especially impact) of Bitcoin ETFs. Forget the halving or efficiency improvements on Bitcoin’s blockchain – neither of them has an effect on the Bitcoin price that is remotely comparable to the emergence of Bitcoin ETFs. Yet many books and discussions don’t bother to address what traditional finance does with crypto-assets at all.

There is one more reason why I would suggest to read The Little Book of Bitcoin and to do so soon: The author’s profile. Scaramucci served as the White House Communications Director and has an excellent feeling of where politics is headed. And currently US politics is what will decide about the short- and mid-term trajectory of the Bitcoin price. It was President-elect Trump’s victory that sent the value of Bitcoin towards $100,000 apiece. Scaramucci’s former boss made many promises on the campaign-trail. Whether they are realized will perhaps matter more to the crypto-world than anything else in the next year.

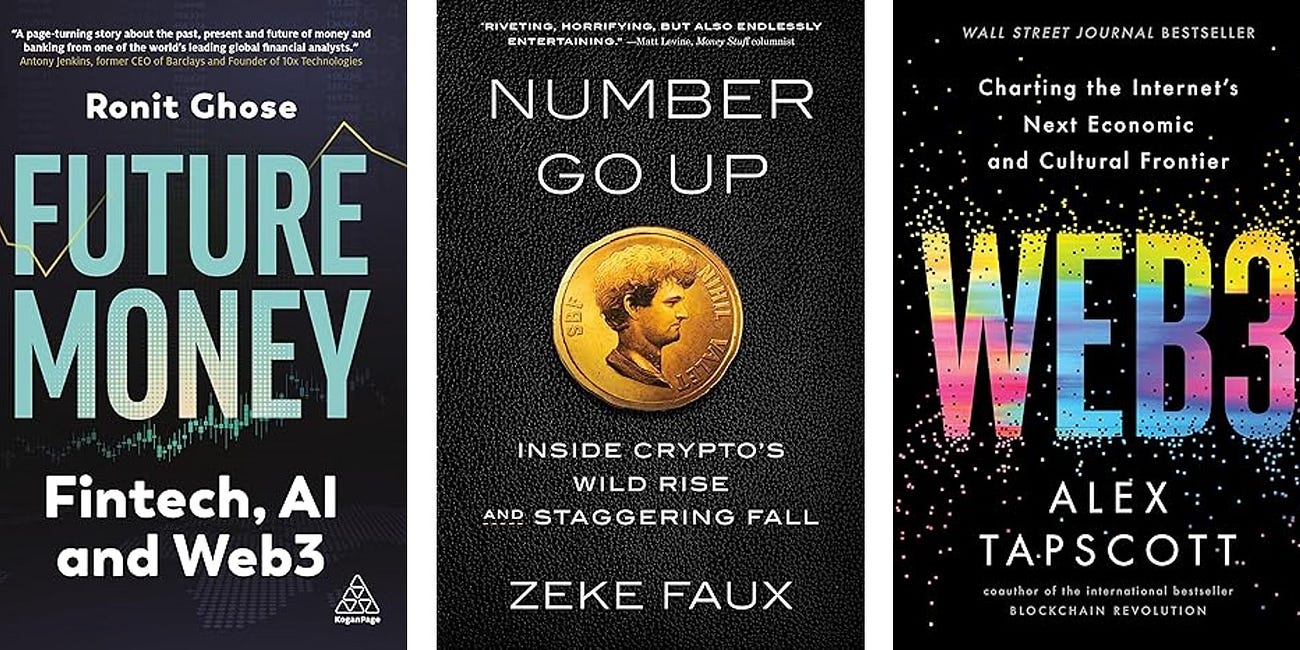

Interested in more books on finance and technology? Check out the list below.

The 50 best books on tech and finance

One thing that comes with being an author is that you are continuously asked what books you can recommend in your area, in my case about tech and banking. So, over the years I have assembled a list of the 50 most important books every financial services professional should read. It includes essential volumes, some hidd…

Introducing "The Money Book Circle"

On the go? No problem. We have you covered with the audio version: Today I am launching a new series as part of The New Frontier. Every quarter I will make three suggestions on what you should read to keep up to date with the big ideas on the future of money

Note: None of the content of this article and this newsletter, nor my books, presentations, and seminars is legal, tax, investment, financial, or investment advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. The content is gathered from publicly available information and the expertise of the author. It does not contain any insider information. Also, as an Amazon Associate I occasionally earn from qualifying purchases.